Morgan Stanley | Steel companies have historically done poorly in recessions. Currently, with the rising risk of recession, spot price margins continue to narrow and we have seen a significant downgrade. It is likely that price lags support Q2 earnings, but we see a significant slowdown from the following quarter. We always prefer carbon steel over stainless steel.

ArcelorMittal (OW): we expect the company to generate EBITDA of $5.1 billion, slightly below consensus estimates. It will be driven by good margins in Brazil and Europe, compensating for production disruptions in the ACIS division. We estimate it will generate FCF of $1.4 billion and therefore maintain its current shareholder distribution programs and announce a $1 billion buyout. Looking ahead to the earnings conference, we focus on commenting on price/cost dynamics in Q3, as well as expectations for freeing up working capital over the rest of the year. Also on the update of cash requirements ($8.4 billion: 4.5 billion in CAPEX, 2.2 billion in interest, 3 billion in taxes and 0.7 billion in other financial charges).

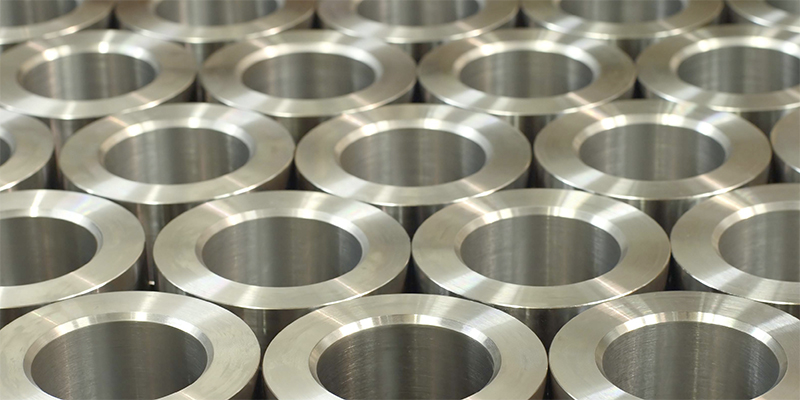

Acerinox (EW): We are forecasting an increase in profits with an EBITDA of €464m, up 10% Q/Q (vs €442m consensus). This increase is driven by improved pricing power and inventory revaluation. Regarding Net Debt, we estimate a reduction to €617m (vs. €705m in Q1), thanks to the increase in profits. Prior to the results conference, we expect the leadership team to: (1) update its Q3’22 EBITDA expectations ((€348m MSe; €290m consensus); (2) comment on the evolution of energy costs and the impact of gas prices; (3) comment on the consolidation negotiations; (4) comment on its expectations in terms of shareholder distribution; and (5) comment on its demand prospects in the various industries.